GIPC Cont….

In 2008, international aircraft movements at the Kotoka International Airport, Ghana’s main point of entry by air, stood at 17,481 with about 1.2 million air passenger traffic. By the end of 2017, the figures rose to 24,968 and approximately 1.8 million respectively.

Although the domestic front has witnessed relatively lower performance in terms of Aircraft movements and passenger throughput as a result of various economic challenges, the segment still has vast potential. Government policies are geared toward improving the competitiveness of operators in the industry in sync with Government’s target of making Ghana a hub for West Africa.

ROADS & HIGHWAYS

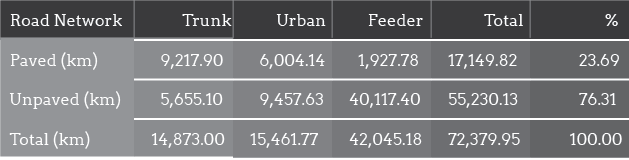

The Road Infrastructure segment is managed by the Ghana Highway Authority (GHA), Department of Feeder Roads (DFR) and the Department of Urban Roads (DUR), which are agencies under the Ministry of Transport. The tables below present indications on the status of the country’s nationwide road network.

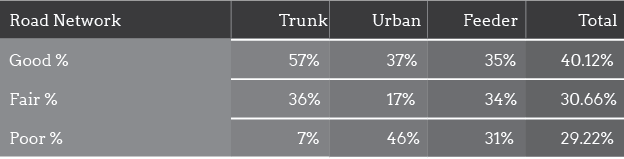

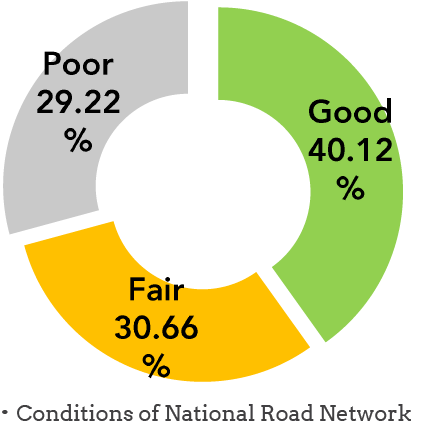

Since the bulk of the inland transport happens on the roads, the quality of the roads is essential to the country’s development. By the close of 2015, about 40.12% of

the national road network was assessed to be in good condition whilst 30.66% was in fair condition. 29.22% was however assessed to be in poor state.

- Inventory of the National Road Network. Source of Stats: MORH

- Conditions of National Road Network. Source of Stats: MORH

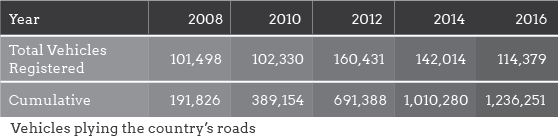

Ghana’s land transport system is presently dominated by road transport. It takes up about 98% of freight and 95% of passenger traffic. From 2008 to 2016, the Drivers and Vehicle service to attract more people to use the MMT and the BRT.

RAILWAYS

The rail industry in Ghana has a total track length of 1300km and operates a route length of 947km. This subsector has witnessed little improvement since the 2000s, hence, Government is actively seeking private sector participation in the development and rehabilitation of the railway infrastructure.

Licensing Authority (DVLA) registered approximately 1.2 million vehicles with an average of 127,325 vehicles registered annually.

MASS & RAPID TRANSPORT

The bulk of passengers on the road network are transported by public transport vehicles such as taxis, mini-buses (‘trotros’) and large buses. In the bid to ensure an affordable, safe and accessible transportation system that recognizes the needs of people, major steps are being taken to promote mass transportation. Thus, the Metro Mass Transport Company (MMT) was established in October 2003. The introduction of the Bus Rapid Transit (BRT) in 2016 in parts of Accra is also a step in the right direction. There is however the need to increase the number of buses and improve on the quality of rail routes to link important exit points which is vital for facilitating trade not only in the country but in the sub-region and boosting Ghana’s competitiveness in doing business. As part of the process for revamping the subsector, a Railway Master Plan to guide the sub-sector development was prepared.

passenger traffic has its infrastructure concentrated in

The network forms a triangle that links Accra-Kumasi-Takoradi. It essentially connects the major mining areas to the sea ports.

MARITIME/SEA & INLAND PORTS

There are two main seaports (or harbours) in Ghana namely Tema and Takoradi. Tema is the biggest port and major operations at this port are skewed towards import commodities such as heavy machinery, containerized cargo etc. Operations at the Takoradi port are skewed towards the export trade with emphasis on commodities such as cocoa, timber, manganese and bauxite. The Tema Port covers 166 hectares of water area enclosedby 2 breakwaters. There are 2 quays housing 12 multi-purpose berths. The berths are operated as common-users, and handle a wide range of cargo including dry bulks, steel products, bagged cargo, newspapers, vehicles and containers. There is also a terminal for handling crude and other liquid petroleum products which can accommodate tankers of up to 244 metres in length with a maximum draught of 9.7 metres.

The Takoradi port, which was commissioned in 1928, has undergone major rehabilitation in the past two decades, and currently handles about 60% of Ghana’s total exports. While Takoradi serves the offshore gas and oil fields, Tema is increasingly serving as an outlet for Ghana’s landlocked neighbours including Burkina Faso, Niger and Mali. The ports are constantly struggling to keep up with the increasing trade flows.

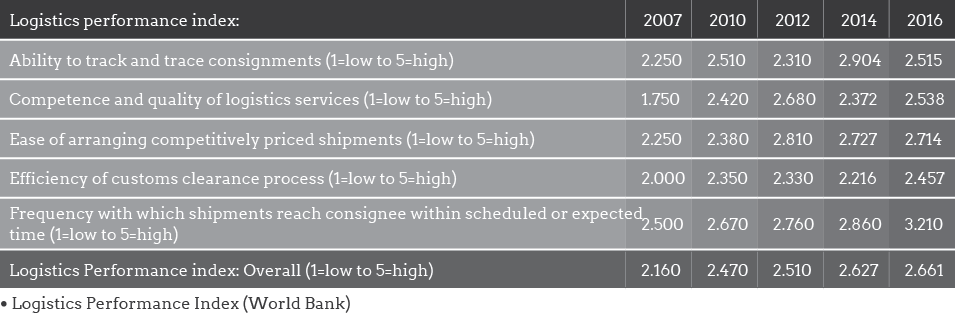

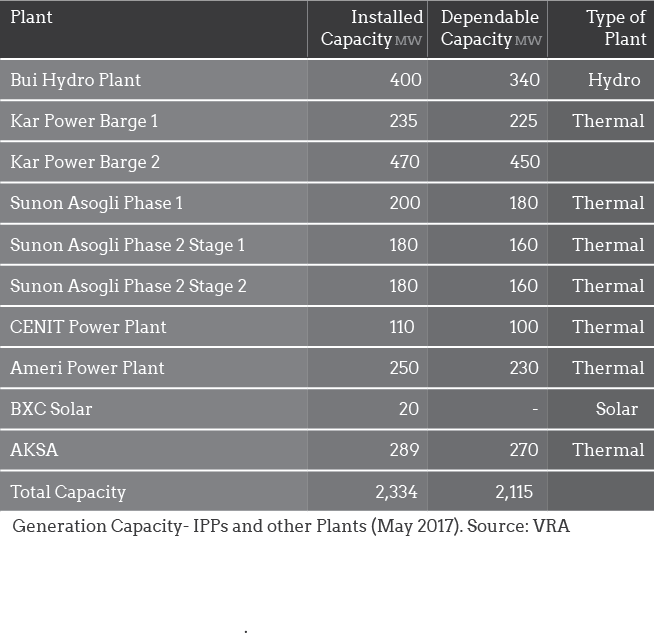

In this light, a new centrally located “inland port” is being constructed at Boankra near Kumasi in the heart of the country. This is expected to be an important staging post for goods in transit to and from the landlocked areas of the Sahel. This will be a multi-modal facility handling both road and rail traffic. Ghana, seeking to serve as a maritime hub for West Africa, has made significant progress in modernizing the Tema and Takoradi ports over the past two decades and is further committed to ensuring further improvements. The efforts are reflected in the country’s performance in the Logistics Performance Index computed by the World Bank over the past decade.

This comes on the back of improving performance in sub-indices like Efficiency on customs clearance process and Frequency with which shipments reach consignee within scheduled or expected time.

ENERGY INFRASTRUCTURE

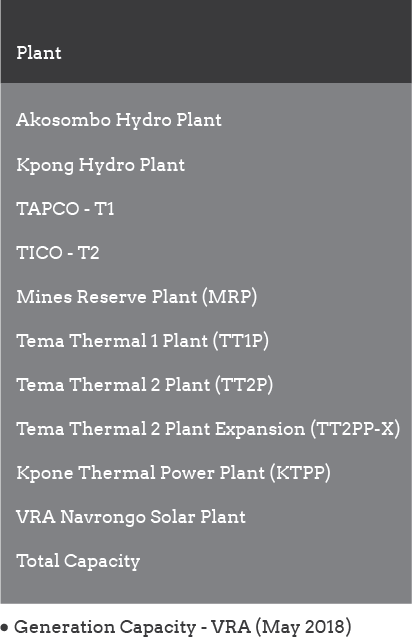

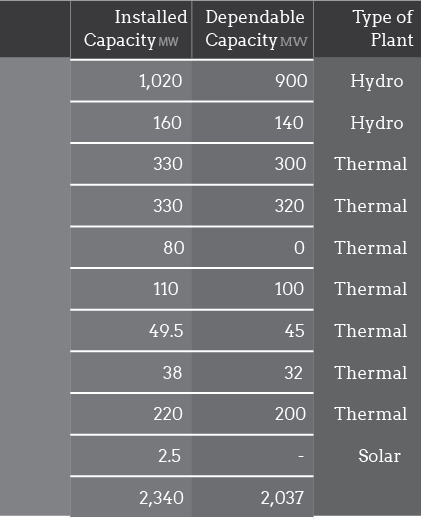

Ghana generates electric power from hydropower, fossil-fuel (thermal energy), and renewable energy sources. The segment involves the generation, transmission and distribution of electrical energy for industrial, commercial and domestic use in Ghana. The sub-sector is mainly run by the Volta River Authority (VRA), Electricity Company

of Ghana (ECG) and Ghana Grid Company (GRIDCO). These organizations play various respective roles in the generation, transmission and distribution process. VRA is the Government agency responsible for the generation of electricity and supplies power in bulk to the Electricity Company of Ghana for distribution to consumers. The Authority however distributes power in Northern belt of the country (covering Brong-Ahafo, Northern, Upper East and Upper West Regions) through its subsidiary – the Northern Electricity Department (NED). Further, there are various private sector owned Independent Power Producers (IPPs) engaged in the generation of power.

As at May 2018, Ghana had total installed generation capacity of 4,674 Mega Watts (MW) with total dependable capacity of 4,152 MW. VRA accounts for approximately 54.74% and 54.84% of both capacities respectively, whilst 2,334 MW and 2,115MW of the installed and dependable capacities respectively was contributed by the IPPs and other plants. Government’s medium-term target is to attain generation capacity of 5,000 MW.

Facts and figures on power generation in Ghana to the right.

HOUSING & ESTATE INFRASTRUCTURE

Housing is a basic human need which improves the welfare of society and contributes to social and economic development. Ghana has been facing a very critical shortage of housing supply in many urban centers, but particularly in rapidly growing towns and districts.

Government estimate suggests a deficit of 1.5 million units across the country, and recommends an annual delivery rate of 150,000 units to meet demand in the next 10 years. The housing sector is largely driven by individual and private sector initiatives, and has to a large extent influenced growth in the economy. In order to address the current housing deficit, Government has created an enabling environment to provide affordable, quality and adequate housing to the majority of the citizens. Government is also encouraging Public-Private Partnerships (PPPs) in the housing development and construction of ancillary facilities.

ICT INFRASTRUCTURE

The infrastructural base of this sub-sector comprises licensed gateway operators, undersea cable connectivity, Private Licensed VSAT Systems, Fixed Wired Line Networks, Wireless Mobile Operators, Public telephones systems, Telecentres, Dedicated Transmission Networks, Public Distribution Networks (cable, TV, DSL, etc.), Internet Backbone Connectivity throughout the Country and Public Access Point and Broadcasting Systems. Over the years, broadband connectivity has improved significantly and this is partly due to the arrival of undersea cable links. Presently, there exist five of them, namely, SAT-3, the West African Cable System (WACS), Main One Cable, Glo-1 and the African Coast to Europe (ACE) submarine cable.

SAT-3 is the first undersea cable to be brought into Ghana. It arrived in 2001 and presently has capacity of 340GB per second. The Main One undersea cable followed almost 10 years later (arrived in 2010) and has 5.12TB per second capacity. In 2011, Glo-1 arrived and has 2.5TB per second capacity. The WACS came on board in 2012 with capacity of 5.12TB per second. Early 2013, the ACE also came on board with 5.2TB.

Ghana has been facing a very critical shortage of housing supply in many urban centres… Government estimates suggest a deficit of 1.5 million units across the country, and recommends an annual delivery rate of 150,000 units to meet demand in the next 10 years

To complement the efforts of the private sector in the extension of affordable and efficient connectivity solutions, the National Fibre Communications Backbone Infrastructure Network aimed at providing open access broadband connectivity is being developed. Following the successful completion of the southern loop, the 2nd phase of the National Communication Backbone from Tamale to the northern parts of the country and neighbouring countries is being pursued.Further, Ghana currently has 5 registered mobile operators, all of which are functional. These are MTN, Vodafone Mobile, AirtelTigo, Expresso and Glo Mobile. Vodafone and AirtelTigo are the only two fixed-line operators.

WATER & SANITATION

Ghana’s water sector is segmented into two parts, identified as the Urban Water sector and Community Water sector. The Urban Water sector comprises about 87 cities and towns where the national water utility – the Ghana Water Company Limited (GWCL) -owns and manages water supply. The Community Water sector deals with over 16,000 rural communities and some 287 small towns. Management of water supply is the responsibility of District Assemblies with facilitation and oversight role by the Community Water and Sanitation Agency (CWSA). Municipal and district assemblies are responsible for investment, operation and maintenance of water and sanitation infrastructure within the community water sector. The Environmental Sanitation segment covers both the liquid and solid waste management and disposal. The sanitation sector is therefore varied, covering very different types of waste, such as organic waste, inorganic and hazardous waste. Depending on the type of waste different methods as regards collection, treatment and disposal are used. The institutional framework places the overall responsibility of environmental sanitation with the Ministry of Local Government, as it is the central government agency in charge of local government affairs and the environment. The responsibility for implementation of environmental sanitation projects and programmes lies with the Metropolitan/Municipal and District Assemblies.

In Ghana, part of the collection and disposal of waste water is done using conventional sewer systems. The sewer systems are at Tema and some parts of Accra, Kumasi and Sekondi-Takoradi. A greater part of consumers uses underground tanks such as septic tanks. The waste is then transported by de-sludging tankers to treatment works or dumping sites. The transportation is done by the waste management department of the district assemblies and private tanker operators. The main types of treatment facilities used in Ghana are oxidation or waste stabilization ponds, aerated lagoons, trickling filter and activated sludge process treatment facilities. The waste water treatment facilities in the country are largely used for treating domestic waste water.

Approximately 10.3 million people (51%) have access to improved water supplies in Ghana. For the 8.4 million residents in the country’s urban areas this increases slightly to 61% with two thirds of these or 40% of the total urban population covered by GWCL’s networks. With GWCL’s unaccounted-for water (UFW) at about 50% of total output, the volume of water that is effectively sold (280,000 m3/ day) is less than half of the daily demand (763,300 m3).

The major consumptive uses of water in Ghana are water for domestic and industrial uses, irrigation and livestock watering. Domestic and industrial urban water supplies are based almost entirely on surface water, either impounded behind small dams or diverted by weirs in rivers.

At present irrigation development does not play an important role in the overall water resources balance considerations. However, the potential for irrigation has been shown to be considerably larger than the present land area under irrigation. The main non-consumptive uses of water are hydropower generation, inland fisheries and water transportation.

On the basis of surface water resources alone, the consumptive water demand for 2020 has been projected to be 5.13 billion m³, which is 13 percent of the surface water resources.

Government’s Policy Direction

The policies of the Ghanaian Government essentially seek to encourage investments in domestic infrastructure from both local and foreign private capital.

The vision and policy direction of the government is one of hope, jobs, wealth creation, and a robust economy that supports a thriving private sector.

This vision is crystalized in a comprehensive set of initiatives and critical interventions outlined in the maiden budget statement and economic policy of government (2017) for the medium to long term toward achieving the industrial transformation of Ghana’s economy.

Infrastructure development is one of the Government’s priority areas and Government recognizes the need to mobilize private sector financing to support public infrastructure development through PPPs as alternative financing for infrastructure development. More specifically, key projects to be procured under the PPP arrangement will transcend across sectors and include roads, railways, boarder support infrastructure, energy, estate and housing, agriculture services, health and airports. Therefore, to cover the infrastructure gap and to improve access to quality and affordable infrastructure service, Government is inviting the private sector to participate in the construction, rehabilitation and maintenance as well as financing of public infrastructure and services.

Sectoral Developments

The following touch on some of the developments ongoing in the sector.

Infrastructure development is one of the Government’s priority areas and Government recognizes the need to mobilize private sector financing to support public infrastructure development…

To cover the infrastructure gap and to improve access to quality and affordable infrastructure service, Government is inviting the private sector to participate…

ROAD REHABILITATION

& MAINTENANCE PROGRAMME

The Ministry of Roads & Highways (MORH) is focusing on routine and periodic maintenance, and minor rehabilitation activities to protect the huge investments made by Government in the provision of road infrastructure. Thus, in 2017, routine maintenance was undertaken on 10,250km trunk, 10,679km feeder and 7,200km urban road networks. This compares with routine maintenance on 110,723.49km trunk, 16,183km feeder and 9,384km urban road network respectively in 2016.

In 2018, the Ministry of Roads & Highways undertook 11,900km, 22,500km and 6,500km of routine maintenance activities on trunk, feeder and urban road networks, respectively. Additionally, periodic maintenance activities (Spot Improvement, Re-gravelling, Resealing, Asphaltic Overlay, Partial Reconstruction, Maintenance of Bridges) will be undertaken. This will cover 350km of trunk, 300km of feeder and 350km of urban roads.

RAIL TRANSPORT PROGRAMME

As part of measures to revamp the railway system, reconstruction of the railway line from Sekondi to Takoradi via Kojokrom consisting of 10.1km double track railway line from Takoradi to Kojokrom and a 4.5km single track line to Sekondi have been completed, leading to the introduction of rail passenger services. Construction works for a railway line from Tema to Akosombo, stretching over a distance of 85km as part of a multi-modal transport system linking the Tema Port to the Buipe Port and neighbouring countries via Akosombo has commenced. This will facilitate the transfer of containerized cargo to and from rail.

RAILWAY INVESTMENT

Management Programme In line with Government’s vision to systematically revamp the rail sector to contribute to the development and the economic growth of the country, the Ministry of Railway Development will reorganize the institutional framework for the sector. The new Ministry will be structured under the traditional four-line-directorates with additional directorates namely: Railways Development and Services, and Railway Investment Management.

The Ghana Railway Development Authority will be separated into two institutions, one as the regulator and the other for managing the infrastructure of the sector.

Ghana’s Competitive Advantage

Stable Political Environment

Ghana is a politically stable country. This has been recognized by the world’s famous leaders including former US President Barack Obama and his predecessors and former UK Prime Minister Gordon Brown and his predecessors who have all commended Ghana for the political stability in the country over the years.

Macro-Economic Policies

The Government of Ghana has initiated a number of sound macroeconomic policies designed to accelerate the process of growth and transformation of the economy under competitive conditions.In the face of high crude oil prices and global credit crunch, Ghana’s economy is still relatively stable. Management and access to foreign exchange in Ghana continues to get better.

Foreign Ownership

In the on going Privatitation Program, Hundred precent (100%) foreign ownership is permitted.

Access to Ecowas Market

Ghana is easily accessible to the markets of all the memebr state of Economic Community of West Africa (ECOWAS) with its populationof approximatley 250 million people.

Good Physical Infrastructure

Ghana possesses well developed seaports, airports and road networks capable of meeting the needs of businesses in the 21st century. There is an effort to upgrade the rail network to make it easy to get to the ports from inland. Telecommunication facilities in Ghana are excellent with more private service providers offering telephone, internet and other telelcommunication services. Basic utilities such as water and electricity are readily available at relatively affordable rates.

Ghana’s Unique Attraction

Ghana offers many attractions to the foreign investor:

A. A stable political environment: Ghana has enjoyed a stable political climate with smooth transition of government over the years.

B. A sound macroeconomic policy: Government’s macroeconomic policy is designed to accelerate

the process of growth and transformation of the economy under competitive conditions. Monetary policy has been consistent and fiscal discipline is apparent from lower budget deficits. Inflation continues its downward course and access to foreign exchange is improving.

C. 100% foreign ownership permitted under on-going privatization programme.

D. A large Economic Community of West African States (ECOWAS) market (300 million people).

E. Good and ever improving physical infrastructure: Ghana has developed seaports, airports and roads network. Telecommunication facilities are available as are basic utilities like water and electricity.

F.Availability of skilled and trainable labour.

G. Competitive labour cost: Ghana also offers a large workforce of both skilled and unskilled labour at affordable and competitive rates. The current minimum wage rate is GHC10.65

ICT INFRASTRUCTURE DEVELOPMENT PROGRAMME

The construction of the 780km Eastern Corridor fibre optic project linking Ho to Bawku and from Yendi to Tamale is on-going. Some of the areas covered by 2018 include:

• Yendi to Tamale link

• Yendi to Tamale link(fully completed and ready for use)

• Bawku to Gushegu(65% complete)• Gushegu to Yendi(95% complete)

• Yendi to Bimbila(90% complete)

• Bimbila to Nkwanta(70% complete)

• Nkwanta to Jasikan(40% complete)

• Jasikan to Kpando(30% complete)

The Ministry of Communication plans to pursue the construction of an offshore fibre optic network in the Western corridor in the medium term. When completed, the project will connect offshore platforms

to parent companies on the mainland as well as provide telecommunication and oil and gas content to the oil industry.

MARITIME SERVICES PROGRAMME

The Ministry of Transport has procured three 50-Seater high speed passenger ferries, to improve passenger and cargo services along the Volta Lake. Furthermore, to improve transportation services on the Volta Lake, construction work on the Eastern Corridor Multi-Modal Transport project is on-going whilst landing sites, access roads, ship building, ports and floating docks have commenced. To facilitate bulk cargo handling facility at the Tema Port, and provide additional berths to reduce waiting time of vessels, the construction of Bulk Cargo Handling Jetty with a length of 450m was completed and operational.

ICT INFRASTRUCTURE DEVELOPMENT PROGRAMME

The three phases of the Digital Terrestrial Television project, covering Greater Accra, Ashanti, Volta, Northern, Upper West and Upper East Regions have been completed. To bridge the technological gap between the served and underserved areas, 20 enhanced Community Information Centre’s (eCICs) were constructed in selected areas in the Northern part of the country. In addition, the Ministry completed and commissioned the refurbishment of the Public Works Department (PWD) warehouses into a world class Business Process Out-Sourcing (BPO) facility. The National Information Technology Agency (NITA)

will begin the process of commercializing its infrastructure to raise enough revenue, maintain, expand and upgrade the infrastructure, sell off the excess capacity as well as expand and improve upon its business operations and modules for MDAs and MMDAs.

Excellent Labor Force

There is a large Human Resource base of both skilled and unskilled labour which can be sourced at relatively low rate. The minimum wage in Ghana is Ghc 9.68.

Access to INT'L Markets

Ghana has easy access to the USA and the European Union Markets. The flight time to almost all European Union countries is about 6hours and 9hours to the USA.

Availability of Fund Sources

Ghana has a large number of fast developing finincacial institutions available to raise to raise long-term capital at competitive rates. These institutions include banks, insurance and venture capital companies and a stock exchange market(Ghana Stock Exchange).

High Safety Standards

There are high standards of health and safety measures in the country.

Warm and Friendly People

Ghana is Internationally accliamed for her hospitality to her investors and foreigners as a whole.

High Quality of Life

The quality of life of Ghanaians is fairly high.

Availability of Land

Ghana has a wide expanse of land that can be acquired with little difficulty through appropriate agencies and owners. Investors interested in Ghana’s Infrastructure Sector are assured of a safe and secure investment environment which has the backing of a very encouraging legal and regulatory regime to protect their investments.

H. Quota-Free access to USA & European Union markets.

I. Proximity to European Union (6 hrs. flight time) and USA markets (9 hrs. direct flight time).

J. Fast developing financial infrastructure: With over 30 banks, insurance, and brokerage firms, and a stock exchange that allows companies to raise long term capital at low cost, Ghana’s finance sector is one of the most developed in Africa.

K. High degree of personal safety.

L. Warm and friendly people: Ghana is internationally recognized for her hospitality and warm affection for her investors.

The policies of the Ghanaian Government essentially seek

to encourage investments in domestic infrastructure from both local and foreign private capital…

AVIATION FACILITY MANAGEMENT PROGRAMME

To improve infrastructure at the Kotoka International Airport

(KIA), work on the expansion of the arrival hall, construction of the southern apron and completion of 3 new boarding gates (to bring the total to five) has been undertaken. This improved waiting time

of passengers at immigration and with the new baggage handling (carousels), waiting time of passengers at the arrival hall has reduced. Other facelift works have been undertaken at the KIA as the construction of a new terminal (Terminal 3) which was completed in 2018 and is expected to handle up to 5 million passengers per annum.

Funding has been secured for the second phase of the Kumasi Airport to cover the construction of a new terminal building, extension of a new runway and other ancillary facilities. When completed, medium to large aircrafts can be accommodated. The first phase of the Tamale Airport which included the runway extension from 2,480 meters to 3,940 meters to accommodate bigger aircrafts was completed whilst funding for the second phase (to cover the construction of an airport terminal building with approximately 5000m² Hajj Terminal, air traffic control tower and fire-fighting services) was approved for implementation in 2017. Construction commenced in 2018.

To cover the infrastructure gap and to improve access to quality and affordable infrastructure service, Government is inviting the private sector to participate…

AIRPORT FREE ZONE

Government has identified the establishment of sector-targeted Free Zones as a major driver for capital inflows and jobs for Ghanaians starting, this year, with the preparatory work for attracting private investment into an Airport Free Zone (AFZ). The AFZ will be purely a private sector investment with government only facilitating the process. Government will explore several options with potential investors.

Investment Incentives/Guarantees

Ghana is a safe investment destination. Guarantee against expropriation of private investments is provided under the investment law and buttressed by the Constitution of Ghana. Some of the guarantees are detailed below:

1. Free transferability of capital, profits, dividends and payment in respect of foreign loans contracted.

2. Insurance against non- commercial risks – Ghana is a signatory to the World Bank’s Multilateral Investment Guarantee Agency (MIGA) Convention.

3. Double Taxation Agreements (DTAs) – to rationalize tax obligations of investors in order to prevent double taxation, DTAs have been signed and ratified with several countries.

Infrastructure Investment Opportunities

There are considerable investment opportunities in the Infrastructure sector. Some of these in the various segments are highlighted below:

1. Roads and Transport

• Major investment opportunities for the

• Major investment opportunities for theroads and railways segments in the areas of construction, maintenance and services.

• In mass transportation -scheduled bus system

• Rail upgrades and passenger rail transport on chosen corridors

• Lake transportation systems

• Air transport operators for domestic and sub-regional services

• Development of regional airports

• Upgrading of existing trunk roads under BOT, BOO, BAT, BLT etc.

2.Energy Sector

• Electricity generation and transmission

• Electricity generation and transmission

• Refineries, storage facilities and pipelines for petroleum and gas

• Renewable energy facilities

• Investment is needed to provide electrical services in the construction of the physical facilities including street lighting, improved coverage/access and service efficiency.

3.Water Supply and Sanitation

The water supply and sanitation infrastructure is insufficient, especially in rural areas. Major investments are needed to extend coverage, rehabilitate and maintain existing infrastructure

and provide Point Sources (boreholes/hand-dug wells), Small Towns Pipe Schemes and Rain Harvest Plants.

4.Ports

• Improvement of Minor Ports

• Improvement of Minor Ports

• Port expansion projects

• Construction of green field ports

5.Hiring and selling heavy equipment for infrastructural construction works